Decoding Balance Sheets for Sales Growth

Last week, we went through the Profit and Loss Statement. This week we’re going to tackle the balance sheet. The balance sheet and the profit and loss statement go hand and hand and should be evaluated together.

What is a Balance Sheet?

If you remember, the profit and loss statement shows the inflows (revenue) and the outflows (expenses) of a company over a fixed period of time, by month, by quarter, by year. A balance sheet on the other hands shows the health of a business and it’s a fixed period of time. In other words a balance sheet shows you a companies financial situation at that particular moment in time.

A balance sheet consists of two main items, assets and liabilities. Assets are things that have value, like cash, inventory, property, equipment, money owed to the company etc. Liabilities are financial obligations of the company like loans/debt, or bills that are due.

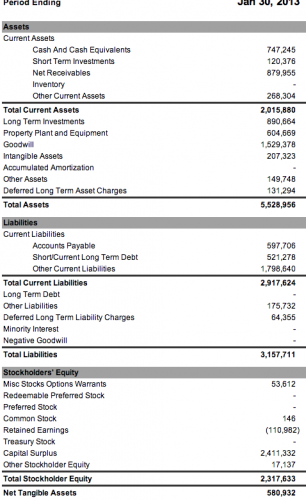

Like the profit and loss statement, let’s look at an example of a balance sheet. Below is Salesforce’s balances sheet of January 30th 2013:

How to Read a Balance Sheet – Assets

Current Assets

The first thing you’ll see on a balance sheet is the assets and the most important asset is cash. Regardless of how much revenue a company makes, regardless of how popular their product, regardless of how fast they are growing if you run out of cash, you’re screwed. When you look at a balance sheet, the first thing you want to look at is cash. Do they have enough to operate the business?

The second line under assets is short term investments. Short term investments are investments that can be liquidated in less than a year. They can be stocks, bonds, etc. The key point here is that it’s easy to turn these investments into cash if necessary. It appears Salesforce doesn’t invest a lot in short-term instruments, about 20% of cash. This could be because they don’t have faith in the current markets or some other reason.

Next on line is net receivables. Net receivables is the amount of money owed to the company for it’s products and services by it’s customers. The thing to think about when looking at this number is how big it is in relationship to revenue (think P&L Statement here). If net receivables gets too high there is a problem. For example if the net receivables exceeds 3 months revenue, there is a collection problem. Another term for this collection problem is called DSO (Days Sales Outstanding). Companies DON’T want DSO to be too high.

After net receivables is inventory. Inventory speaks for itself. The inventory line item is the value of all the inventory the company is carrying at the time the balance sheet is done. Being a software company, Salesforce doesn’t carry inventory. If what you sell affects your customers inventory, it’s important to understand this number and it’s relationship to total assets as well as inventory turn or inventory velocity. We’ll talk about those two terms in a later post.

Long-Term Assets

The next set of assets are long-term assets. Long-term assets are assets that are difficult to liquidate or turn into cash. The general rule of thumb is they take more than a year to turn into cash. Salesforce has almost 900 million dollars tied in long-term investments. I’m not sure what they are, but they can be things like investment in other companies or start-ups. It can be difficult to determine what represents a companies long-term investments but might be found in the 10K. Property and Equipment is most often the most important long-term asset. It represents the assets necessary to run the business. It’s the cost of the capital equipment.

Salesforce has just over 600 million in property and equipment. I suspect a big portion of that is their servers. If they don’t rack their own servers and house their own infrastructure, I don’t know what type of asset, consistent with Salesforce’s business, could represent such a large number. It’s important to understand this line item if the product you sell falls into the capital equipment category.

Next is goodwill. I love this one. Every time I hear it, it makes me think of the charity and secondhand store Goodwill. The best way to describe goodwill is to think about it as overpaying. If a company pays more than “book value” when buying a company, the difference has to be accounted for. This is called goodwill. Salesforce goodwill number is 1.5 billion dollars. This is high in relationship to it’s total assets, almost 20%.

Salesforce has bought a number of companies over the last few years. I’m sure this number is partly the result of their recent buying spree which has included Buddy Media for 659 million, Goinstant for 70 million, Thinkfuse and ChoicePass. If overtime a company feels the goodwill of an acquisition has declined, they can write it down and that occurs as one-time expense hit on the P&L.

Reading a Balance Sheet – Liabilities

Now that we’ve totaled up all the good stuff, the stuff “owned,” is owed to the company or has value, we have to look everything we owe. These are called liabilities. After cash, liabilities or debt is the most important part of the balance sheet. Debt can bury a business. Not just the amount of debt but also the terms of the debt, which aren’t represented in the balance sheet. Debt eats at cash and that leaves less for operations.

Current Liabilities

The first line in this is Current Liabilities. Like current assets, current liabilities are things due immediately. The fist type of current liabilities are accounts payable. In Salesforce’s balance sheet it appears they are including accrued expenses with accounts payable. Accrued expenses are the anticipation of things like employee benefits coming up, interest on loans, services yet to be invoiced etc. While accounts payable are for services where expenses are due, and that have been invoiced by vendors.

The last liability I’m going to address here is other current liabilities. Salesforce.com has almost 1.8 billion in other current liabilities. I have to confess, I’m not sure what that is and why it’s so big. Other current liabilities can include tax liabilities (sales and payroll), current maturity of debt, in other words, some or all of a long-term debt due within the year or it also can be unearned revenue. Unearned revenue is when cash is received before the service is delivered. Being a subscription business some of this liability could be unearned revenue.

Long-Term Debt

After current liabilities is long-term debt. Long-term debt could be for a money borrowed for a plant, real estate etc. In Salesforce’s case they have no long-term debt.

Once all these numbers have been compiled, we simple have to subtract total liabilities from total assets and you’ll know how well the company is operating. Remember however, cash is king. If the assets far outweigh the liabilities yet their is little cash on hand, the company is a short road away from trouble. Salesforce.com has $5.5 billion in assets and $3.2 in liabilities. They are doing well. I wouldn’t say they are crushing it, but a 2.3 billion dollar separation isn’t something to lose sleep over. Remember the closer these two numbers are the more precarious the companies situation is.

Salesforce has 700m in cash on hand. However, their annual expenses (see P&L) total 2.4B. This means Salesforce has less than one years operating capital on hand. Salesforce is a subscription based company, so their revenue is more protected than most companies, but comparing cash on hand to operating expenses is always a good thing.

Stockholder Equity

The last part of the balance sheet is the Stockholder Equity. Stockholder Equity is made up of primarily two things, the amount private equity and public investors have in the company and the retained earnings. In this case Salesforce’s total Stockholder Equity is 3.1B. In essence this number represents “book value” Saleforce.com’s “book value” is 3.1B dollars, which is just 8% of it’s market cap. We’ll address market capitalization in another post.

There you have it. A balance sheet highlights the capital in a business at a point in time. The more capital the better the business. Pretty simple really. To get a good feel of a business read the P&L and the balance sheet at the same time. It will give you a much better picture of what is actually going on.

WITCE (What is The Customers Experience) Balance Sheet Questions:

- How does your product or service affect the balance sheet??

- Does buying your product require debt, if so can the company you are selling to afford the debt?

- Does your product or service improve the balance sheet?

- Is your product or service too small to make a dent in the balance sheet?

- How does your customers current financial situation affect their ability to purchase what you are selling?

- What do the balance sheets of companies in your industry typically look like? Are their common threads? Are there anomalies associated with that industry only? If so, how do the affect what you sell?

- Are the companies you’re chasing healthy companies or struggling ones?

- Does the balance sheet of your target companies affect what you sell and how you sell it? No? Why not? Yes? How?

- How can the balance sheet affect your deal strategy?

How does your product of service affect the balance sheet experience of your customers and prospects?

The balance sheet is a cool instrument to gauge the health and stability of a company. When it’s available, take the time to check them out, ya never know what you might learn.

0 Comments